Biobanking Industry | Forecast 2030

Biobanking Industry Data Book - Biobanks, Cell Banking Outsourcing, Cord Blood Banking Services, DNA & RNA Banking Services Market

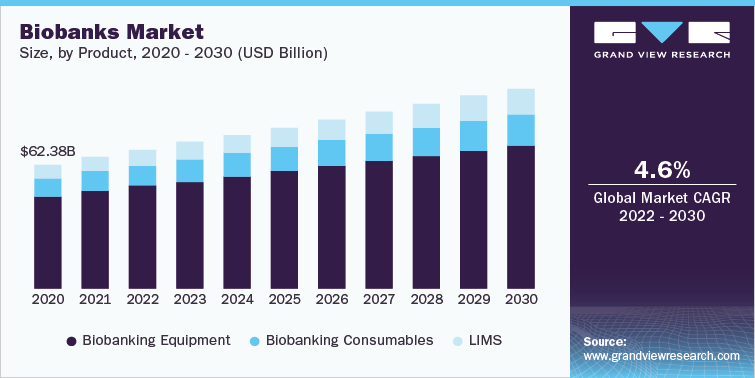

Biobanking industry data book is a combination of the market data from four reports namely, biobanks, cell banking outsourcing, cord blood banking, and DNA & RNA banking services market. Biobanks market was valued at USD 66.06 Billion in 2021 with CAGR of 4.6% during 2022-2030. Cell banking outsourcing market projected to grow at the CAGR of 16.39%.

Access the Global Biobanking Industry Data Book, 2023 to 2030, compiled with details like market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking, macro-environmental analyses, and regulatory & technological framework studies

Biobanking Industry Data Book Coverage Snapshot

Markets Covered

- Biobanks Market Size USD 66.66 billion in 2021 4.6% CAGR (2022-2030)

- Cell Banking Outsourcing Market Size USD 9.86 billion in 2021 16.39% CAGR (2022-2030)

- Cord Blood Banking Services Market Size USD 35 billion in 2021 11% CAGR (2022-2030)

- DNA & RNA Banking Services Market Size USD 6.7 billion in 2021 9% CAGR (2022-2030)

Biobanks Market Growth & Trends

The global biobanks market size is expected to reach USD 136.9 billion by 2030, according to a new report by Grand View Research, Inc., registering a CAGR of 8.6% during the forecast period. Biobanks continue to evolve with the introduction of new technologies, such as NGS, and increased focus on genomic medicine. The availability of several types of biospecimens to cater to multiple domains including drug discovery, diagnostics, and others has accelerated the diversification of biorepositories, thereby driving the market. The quality of biospecimens can significantly influence disease testing as well as preclinical and clinical research. Regulatory agencies have played a vital role in spurring the adoption of biobanking services by establishing guidelines for the effective management of samples.

For instance, the U.S. Centers for Disease Control and Prevention (CDC) released guidelines to minimize human hazards while handling COVID-19 samples. This serves as a model for other biorepositories. Furthermore, as the number of research studies and clinical trials related to COVID-19 is increasing, the demand for high-quality biospecimens is expected to significantly increase in the near future, leading to market growth. In addition, population-based cohort studies are facilitated by biorepositories to estimate the actual seroprevalence. Health Catalyst, Inc., through its Touchstone platform, provides national data related to COVID-19 insights. Such factors are anticipated to contribute to the revenue flow in this space.

Order your copy of the Free Sample of “Biobanking Industry Data Book - Biobanks, Cell Banking Outsourcing, Cord Blood Banking Services, DNA & RNA Banking Services Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030, published by Grand View Research

Cell Banking Outsourcing Market Growth & Trends

The global cell banking outsourcing market size is expected to reach USD 35.59 billion by 2030, registering a CAGR of 16.34%, according to a new report by Grand View Research, Inc. Introduction of novel technologies for the collection, testing, and storage of cell lines are expected to boost the cell banking market during the forecast period. Automation in cord blood processing and storage are the key technologies that are expected to affect the growth of the market.

CellTrials.org found that global enrolments of new trials in advanced cell therapy were up almost 30% in the first quarter of 2020. Most of the rise can be associated with cell therapy efforts for treating COVID-19, and over half of those trials for COVID-19 employ umbilical cord MSCs. Hence, the pandemic has created a new market for those companies which are engaged in the manufacturing of MSCs products.

Cord Blood Banking Services Market Growth & Trends

The global cord blood banking services market is expected to reach over USD 82.3 billion by 2025, growing at an estimated CAGR of around 11.9% from 2017 to 2025, according to a new study by Grand View Research, Inc. Key drivers of the market include increasing application of stem cell therapies in disease treatment, and rising prevalence of life threatening genetic disorders.

Moreover, increasing spending capacity is fueling the demand for advanced healthcare facilities including disease prevention and treatment. As a result, parents are increasingly demanding CBB services to ensure safety of their child’s future. Furthermore, private players are practicing marketing activities which are creating awareness about the availability of the CBB services and their benefits.

Go through the table of content of Pet Food Industry Data Book to get a better understanding of the Coverage & Scope of the study

DNA & RNA Banking Services Market Growth & Trends

The global DNA and RNA banking services market size is expected to reach USD 8.83 billion by 2027, according to a new report by Grand View Research, Inc. It is expected to expand at a CAGR of 5.46% from 2021 to 2027. Biospecimens such as DNA and RNA are critical for biomarker discovery, thereby providing a path for the expansion of personalized medicine. Moreover, progress in translational and clinical research through an introduction of advanced, standardized cell isolation methodologies reduces hands-on-time. The development of automated solutions and the transformation of biobanks into fully automated biobanks potentially accelerate the growth of the market.

A rise in the enrollment of individuals for personalized medicine initiatives drives the revenue generation for DNA and RNA banking services. In July 2019, Partners HealthCare, U.S. enrolled more than 100,000 individuals in its precision medicine biobank that supported clinicians and researchers of the Brigham and Women’s Hospital, U.S., and other partners. Such initiative assisted in examining the impact of several factors on disease and health.

Competitive Landscape

Competitive rivalry in the biobanking industry is high due to the presence of a large number of both well-established players and small- to mid-sized companies as well as biobanks in the market space. Some of the major players are Thermo Fisher Scientific Inc., Charles River Laboratories, Merck KGaA, Cord Blood America, Inc., Becton, Dickinson and Company, Cryo-Cell International, Inc, PromoCell GmbH, SGS Life Sciences, and Lonza Group AG among many others. These market players are involved in the manufacturing of various products associated with cell banking industry including reagents, consumables, and equipment along with certain services.

Check out more Industry Data Books, published by Grand View Research

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: [email protected]

Web: https://www.grandviewresearch.com/sector-reports-list